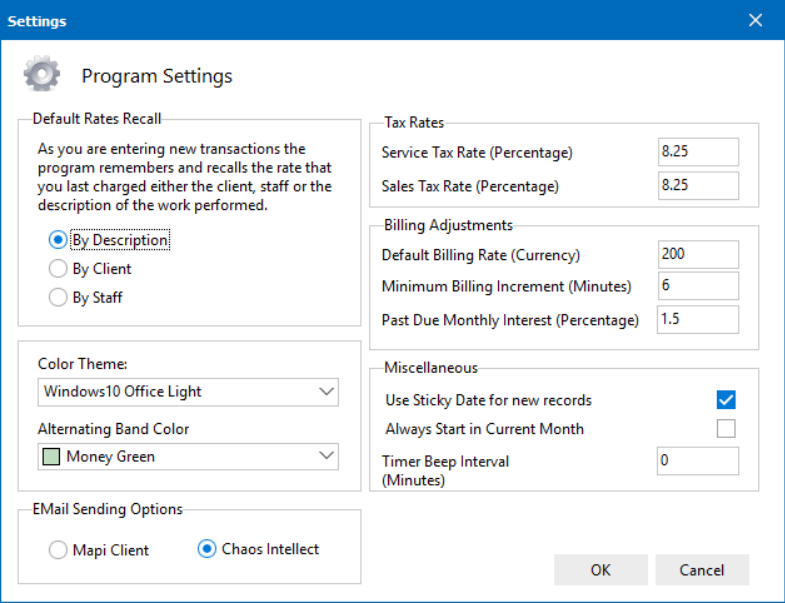

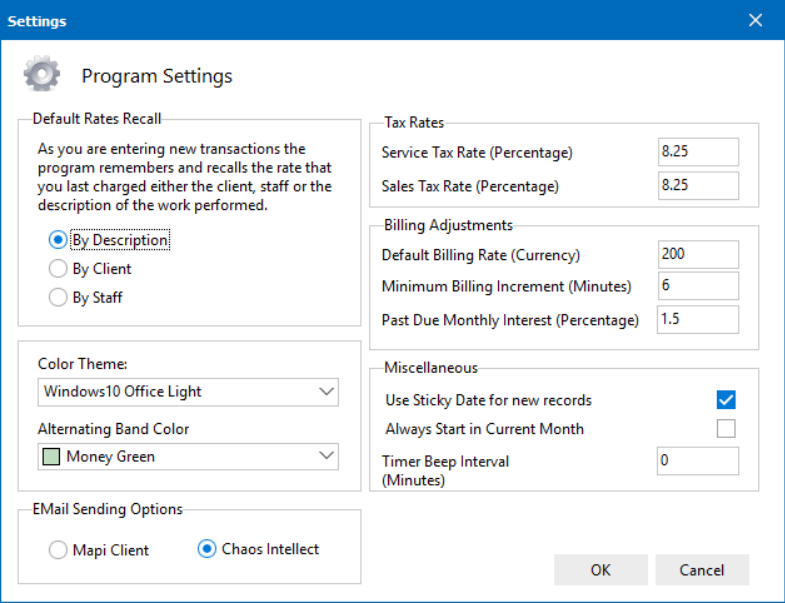

The SETTINGS option under the File menu at the top left allows you to setup your main program preferences.

When you are adding new timeslips, after you choose a description and tab to the Rate field, the program can save and recall rates based on what Description you reused, what Client name is selected, or what Staff member is selected. Most offices do this by Description so you can charge different rates for different types of tasks, but other offices have asked for the flexibility to save rates by client or staff, so this choice is where you make that choice for your timeslips.

In Tax rates, you can specify two different tax rates; one for State Sales Tax Rate and another for State Service Tax Rate. The State Sales Tax is automatically applied to expense transaction while the Service Tax Rate is automatically applied to all billable activities. Once you have specified these tax rates, all new transactions will have this checked by default. Should you encounter a non-taxable exception you can simply uncheck this TAX option.

If you enter a number in MINIMUM BILLING INCREMENT box, the INCREMENTAL BILLING box on the TRANSACTION DETAILS screen will be checked. If you enter "6", then the time for any activity will be rounded up to six minute units and bill in tenths (.1) of an hour.

Past Due Interest is used to help you quickly apply a penalty to a client with a unpaid balance. Under the EDIT menu of the program is an option to "Add Past Due Interest" which when clicked will add a new transaction to the current client statement. Taking the previous balance and multiplying it by the percentage that you have entered in this field.

This help article applies to Legal Billing 7 or newer